Mike Monteiro is a genius that tells good ideas about managing customers and clients… from a designer perspective. Good video worth watching.

Category: Time Management

In America, you can make mistakes, fail, and it doesn’t matter.

My brother in law posted this link to Facebook today. My initial reaction was aww about how different Japanese culture is from American. But then, the very last paragraph stuck out to me.

In America, you can make mistakes, fail, and it doesn’t matter. It is a fundamental feeling that to sometimes be incorrect is natural. In addition, rather than thinking about mistakes and failures, American’s have curiosity and say, “Let’s try anyway!”

There it is. That’s what describes Americans. It describes American attitudes towards life, business, and work.

The article describes Japanese thoughts about failure. Here they are:

In Japan, there is great fear of failure and mistakes in front of other people. It is better to do nothing and avoid being criticized than to taste the humiliation of failure. As a result, there are things we wanted to do, but did not, and often regret.

Rather stunning, isn’t it? It sure makes you realize how often we fail. We fail every day when we aren’t able to cross everything off of our to-do list. But that’s what is so great about a week. There are 5 working days. So, we can try tomorrow.

Here’s to trying.

“Success is the ability to go from failure to failure without losing your enthusiasm” ― Winston Churchill

Watching movies while you work on the computer

Occasionally instead of listening to music while I work, I’ll put on a movie. Either something I’ve seen before, or a new movie or TV show. Strangely enough, at times this can help me to concentrate on the task at hand — by giving me something to watch and listen to so I don’t browse the internet.

I’ve got to say, it’s a strange thing, but it keeps me focused to have something on to distract me. It’s as if half of my brain is bored with my task — maybe a mundane task — and just wants to be entertained.

While the rest of my brain works — on paperwork, design, or whatnot.

The best loan customer is someone who has no passion whatsoever

This is a fascinating point from Scott Adams. I’m going to be thinking about this for a while.

But the most dangerous case of all is when successful people directly give advice. For example, you often hear them say that you should “follow your passion.” That sounds perfectly reasonable the first time you hear it. Passion will presumably give you high energy, high resistance to rejection and high determination. Passionate people are more persuasive, too. Those are all good things, right?

Here’s the counterargument: When I was a commercial loan officer for a large bank, my boss taught us that you should never make a loan to someone who is following his passion. For example, you don’t want to give money to a sports enthusiast who is starting a sports store to pursue his passion for all things sporty. That guy is a bad bet, passion and all. He’s in business for the wrong reason.

My boss, who had been a commercial lender for over 30 years, said that the best loan customer is someone who has no passion whatsoever, just a desire to work hard at something that looks good on a spreadsheet. Maybe the loan customer wants to start a dry-cleaning store or invest in a fast-food franchise—boring stuff. That’s the person you bet on. You want the grinder, not the guy who loves his job.

Is it worth it to get a GIUL Policy?

I was recently pitched on the value of a Global Indexed Universal Life Policy from ING. I came up with some math showing how it’s a really bad value in the shorter term (20-30 years). Obviously, these policies have potential for tax savings at the 70 year old mark (assuming an investor in their early 30s), however they lock you in to a single investment strategy over a very long period of time.

I was quoted $438.06 per month fee for the GIUL.

I don’t believe that I anyone can afford these GIUL policies because it forces people to invest in the same way for a 30-50 year timespan. I think that people would rather have more control over my investing choices. Personally, I’d rather be able to change my mind and invest in different sectors like real estate or mutual funds of my choosing. With a GIUL you do not have that control.

Also, it’s like a forced savings plan, and it just feels unsafe in that you would have to make that payment every month. Miss it? Risk losing everything.

Throwing money away for the first 7 to 10 years!

Since there’s basically no benefit for the first 7 to 10 years (except the life insurance death benefit which is an important benefit) I felt like the next 7 to 10 years are the ones I would like to have liquid assets (and, working on paying off house).

Contrast: I think I can get term life insurance for approximately $100/month.

I took the last 20 years of the S&P 500 and it looks like it had an annual rate of 6.24% from Dec 31, 1992 through Jan 2, 2013. Investing $338.06 per month for those 20 years would have resulted in a return of approximately $162,692.37 which is more than the 20 year net surrender value of the GIUL policy. The GIUL policy has a surrender value of $149,307 at 20 years (assuming 8.5% return).

Assuming a term life policy only cost me $100 month during that period, I would be only down $24,000. Plus, if I were to die 20 years from now, and carried a term policy at that time, I’d have the death benefit from that + my investment return as well. I am having difficulty seeing why I wouldn’t want to do that.

It’s very important to run the math on these! Instead, fund your Roth IRA to the max.

From what I can understand about a GIUL policy, the death benefit would be all a person would receive if I were to die before an older age.

In other words, if you die, you only get the death benefit, and none of that money you’ve been “investing.”

That’s just not a good investment practice. Why risk that? For less money, you can have a term life insurance policy that protects you, and then anything I invest I know I will have access to. It’s way more liquid. I’d much rather wake up 20 years from now having “invested the difference” and have a liquid nest egg than have it be tied up in an insurance policy.

Your insurance salesperson will tell you that you do have access to that capital… by explaining that you get access to that money by borrowing it from the policy, but there are some tax implications there that can’t be overlooked.

I also am having a hard time coming to terms with the idea that if I died within the first 7-10 years I am not further ahead than if I “invested the difference”.

The insurance salesperson will ask: Will you really invest the difference? The answer is yes, absolutely! I’ll invest it in life, travel, and retirement.

A few questions to ask your insurance salesperson:

Question: Is there a cap on how much I can earn on the investment? I read somewhere that dividends earned by the S&P 500 aren’t paid out, is that true? What are my approximate fees? From reading an article, I get the idea that long-term it actually pays off admirably. But, I guess I’m just not so convinced of the idea that I should limit myself to placing a sizable percentage of my income for the next 30+ years into one investment method.

As a comparison, you’ll want to fund a Roth IRA to the max ($5,500/year) every single year that you can. Never miss a year.

What if you die at an early age?

Looking at it further, if I were to die at 63 (age my mom died) after 30 years of investing in the GIUL policy I would have invested about $152,444.88 over that time. The death benefit is $500k and the Net Surrender Value is $380,194.

If we take the S&P 500 average over the last 30 years we get 8.120% return. After 30 years of investing $338.06 on a monthly basis I would end up with $507,944 which is more than the death benefit. Let’s guess over that period I would have paid out $36,000 for a 30-year term (might be low). Even taking half of the proceeds for taxes and fees, with a term-policy my spouse would be left with a term-life death benefit and the “invest the difference” investment of maybe $250,000.

The GIUL looks like a really good deal if I don’t die. And that’s the trouble. You don’t know, and if you do die, you’ll have lost a fortune.

There are a ton of videos on YouTube where insurance salespeople will pitch life insurance, and provide various examples of why term-life insurance is a bad deal. Here’s one example showing a sales person attempting to show how to handle a customers objections.

You’ll obviously want to do your own research. Personally, I came to the conclusion that the GIUL Policy is a very bad deal, and that you should always go with term life insurance. Don’t get talked into a fancy life insurance policy! It isn’t worth the risk. Seriously, don’t even consider getting anything besides a term life policy.

Note: I don’t sell life insurance, never have, never will. I’m a designer and writer, and not in that business at all. Take my advice: Don’t get a GIUL!

List of Time Tracking Apps: Our very own time tracking tools list

A lot of people probably are unaware that we maintain a list of time tracking applications. We realize that everybody tracks time for different reasons and a time tracking tool that works for one person might not be perfect for another.

That’s why we encourage you to check out TimeTrackingResources.com where we currently have links to over 50 time tracking apps — from software to web. We’ll be maintaining this list and adding new apps whenever we spot a new one. Thanks!

Note: Our list is often updated, and the latest update was on August 5, 2013.

An observation about time tracking software

When selecting a time tracking tool it is important to choose something that offers you both flexibility and is easy to use. If you’ve ever used Basecamp, Freshbooks, or Harvest to track your time you’ll be familiar with the fixed “Client > Project > Tasks” structure which you must follow. Time must fit into that a project and projects must be associated with a client.

But what if you want to track your non-billable time or don’t need a whole “project” just to track a few hours here and there? That’s where these tools break down. If you want to track time for trivial tasks like “Email” or “Writing Proposals” you’re out of luck.

Most time tracking tools make it difficult to calculate your billable efficiency — the percentage of your time that is billable compared to non-billable. If you track all of your time this is possible.

Cost of commuting

Something I’ve been thinking about lately is the cost of commuting. If your daily commute takes 20 minutes (round trip), as mine does, how much time are you really spending per-month, and per-year behind the wheel?

Something I’ve been thinking about lately is the cost of commuting. If your daily commute takes 20 minutes (round trip), as mine does, how much time are you really spending per-month, and per-year behind the wheel?

Let’s do the math.

There are 251 working days in 2013, and assuming 10 days of vacation per year it’s safe to assume the average person will commute 241 days out of the year.

Therefore, we come down to total time behind the wheel in 1 year: 80.33 hrs. DANG! So, yeah, for a short commute like that, the average person spends two-work-weeks behind the wheel. Tragic.

You could be spending more than 160 hours, or a months worth of work-time behind the wheel every year if you have a 20 minute one-way drive.

So, what is the true cost of commuting? Well, add in gas and lost-time and it could be significant. Is it really worth it to spend that much time in your car?

Time tracking: Choosing a time tracking system for your business

What time tracking application do you currently use for your business? There’s definitely a lot to consider, and I think everybody is looking for something a little bit different.

What time tracking application do you currently use for your business? There’s definitely a lot to consider, and I think everybody is looking for something a little bit different.

Here’s what I have been looking for:

- Logging of time with start and end date stamps – I need to know when this time was logged… not just the day it was logged.

- Easy invoicing – either in the service, or really great export options to Excel or another invoicing app – like Freshbooks.

- An OS X app – it’s 2012 people, I need to do this on the desktop. Also, iPhone apps are great and I like that as a bonus.

- Daily report – I posted a few years ago about how I work, and one of the things I love about Complete Time Tracking Pro is the daily report. It’s beautiful and shows me the gaps in my time logs.

So, what are some of the apps I am considering:

- Complete Time Tracking Pro – have used this for over 5 years – awesome Windows app, but it’s time to move on to something that’s a little more modern, and web based, and has an OS X desktop app. I know certain people (yes, you) will think it’s crazy to move on, but I’m not so convinced that another app will really reduce my productivity or reduce my ease in invoicing.

- Harvest – seriously considering this as a viable option.

- Toggl – looks really nice and I like some of the interface ideas they have implemented.

I may do another post in the future about my selection. If you’re interested in this topic, check out my article from 2010 about my obsession with time tracking.

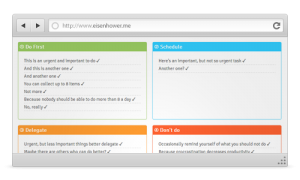

Dwight D. Eisenhower Productivity Tips

The battle between the organizers and the hoarders

Organizing Is Often Well-Planned Hoarding. The key paragraph:

“No matter how organized we are, we must continue to care for the stuff we organize, cleaning and sorting our methodically structured belongings. When we get rid of the superfluous stuff, however, we can focus on life’s more important aspects. Said another way: We can spend the day focusing on our health, on our relationships, on pursuing what we’re passionate about. Or we could, of course, reorganize our basement again.”

Two-year study of tax lawyers at an undisclosed Big 4 firm

Interesting results from a two-year study of tax lawyers at an undisclosed Big 4 firm.

Increase my productivity on my side projects at the end of the day

Some great ideas at this Quora answer.

Keeping as much state persistent across sessions as possible. I leave all my editors, browser windows, etc exactly the way they are so I can pick up and resume where I left off. This means I usually never shut down my computer, preferring to put it to sleep or standby where possible.

30 minutes a day

Everything else in your day – is not important. You just have to do these two things. Nothing more, nothing less.

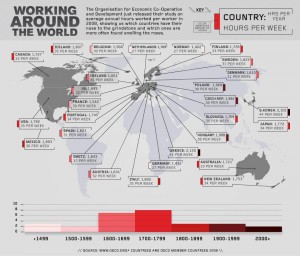

Average number of hours people work in United States

The average work week in US is 43 hours. To be precise, it is on average 8.6 hours per day worked.

Working 11-12 hours is definitely not common. Of the few people I know who do it, all do it voluntarily.

People consistently overestimate the number of hours they work, particularly if they work more than 40.

What causes burnout?

This is so true: Burnout is caused by resentment

When people have to make sacrifices for work – like missing their child’s soccer game – they end up being resentful. She is proactive with her employees to make sure they don’t experience lots of resentment-causing activities. If being at tuesday night dinner with friends is the one thing you need to keep you happy, you should be there every week.

14 Life Lessons From He-Man

My friend Andrew shared with me a sweet video – 14 Life Lessons From He-Man.

Hours per week

Writing good time entries

An interesting post about what makes a good time entry.

The good ones are clear and descriptive. They include more text and i can understand what was worked on even if i wasn’t following the project day to day.

Hell Yeah, or No, Say Yes to Less

Related blog post about over-committing.